On a quarterly basis AZ InfoCollection, an infoproviding leader, monitors changes in the current profile of italian debtors in the consumer credit sector.

AZ InfoCollection, a company that provides information services with the purpose of economic and social profiling of clients receiving credit services, provides a quarterly analysis of debtor profile in the consumer credit sector.

With the help of a proprietary database, cyclically refreshed, AZ InfoCollection, six months ago admitted to the Elite program of Italian Stock Exchange, develops its own point of view on the scenario of italian debt.

Specifically, the Antonino Restino Group has developed a detailed report, the AZ Statistical Observatory, which is profiling the types of Italian debtor:

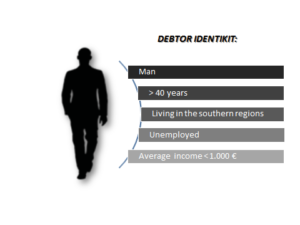

The average Italian with problems in loan payments is a man (64.5%), unemployed (48.6%), older than 40 years of age (73.6%), living in the southern regions of the country (58, 9%) and with an average income less than 1.000 € (63.2%).

The AZ InfoCollection analysis illustrates an allarming fact concerning the increasing impossibility of women to support themselves.

An important element is the reduction of the gap between men and women, which becomes a clear signal that both are attempting to access credit using all available financial sources.

If you want to find out more about a detailed italian debtor prifile, read the full version of AZ Statistical Observatory.

Follow AZ InfoCollection on Twitter, Facebook, Linkedin, Youtube e Slideshare to constantly be updated on the news!