An insurance fraud is a real scam through which one tries to extort money from an insurance company in a fraudulent manner.

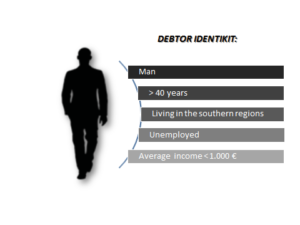

In recent years, the economic crisis has turned insurance fraud into a real social security cushion: a phenomenon by means of which individuals with the help of professionals such as lawyers, doctors, court experts seek to deceive insurance companies simulating fires, robberies and events of this kind.

There is one way to protect from this type of phenomenon: prior to signing a contract, insurance companies should make an “assessment” of their potential new customer.

From this research, a person’s involvement in advanced claims from any insurance company could emerge. For this kind of protection the company can turn to AZ InfoCollection: the group is in fact owns a database with daily updated information relating to road traffic accidents (names of insured counterparts, witnesses, license plate numbers, medical centers, law firms , etc.), that highlights in real time occurrences of data, underlining possible cases of serial fraud.

In recent months, the number of insurance companies that appeal to the investigation agencies has increased significantly. The goal is to test, verify and determine if everything stated in a claim for damages, sent by a lawyer to the insurance company is true, partially false or completely fake: a goal achievable thanks to a meticulous activity of the investigation agency.

Want to know more? Discover our activities about Insurance fraud protection service!